India China Pharma Concerns For 2021

As per the recent developments, the larger scale of India has boycotted products imported from China due to escalated tensions between the two countries. This also has affected the pharmaceutical products like APIs (Active Pharmaceutical Ingredient).

Compared to China, the Indian pharma sector is largely dependent on products such as APIs. In short, the key component of any finished drug product (bulk drugs) is called API.

The Indian generic drug market has grown to become one of the world’s largest. While that is true, the long-term impact of Indian pharmaceutical companies’ dependency on Chinese APIs is quite significant.

According to data released by Pharmaceutical Exports Promotion Council of India (Pharmexcil), a body under the Union Ministry of Commerce and Industry, exports in FY-2019 of bulk drugs or APIs and Intermediates touched as close as $4 billion, nearly 11% more than the previous year.

APIs and intermediates are among the most commonly imported products from China, with nearly all requirements being met by Chinese manufacturers. These products account for about 70 to 90% of the total requirement.

In other words, API manufacturing facilities in India are only able to meet 10 to 30% of the demand. It seems we’ve already turned over our API market to China.

Table of Content

Statistics on India China Pharma Sector

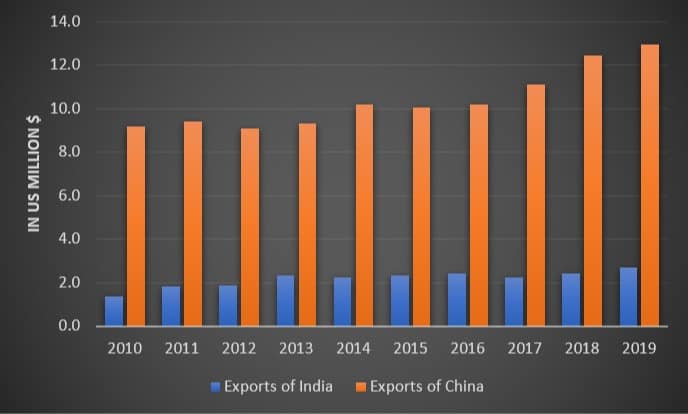

Import-Export is the primary indicator to understand how a particular sector grows economically.

Let’s see the historical data for India China pharmaceutical export in U.S. million $ from the last 10 years.

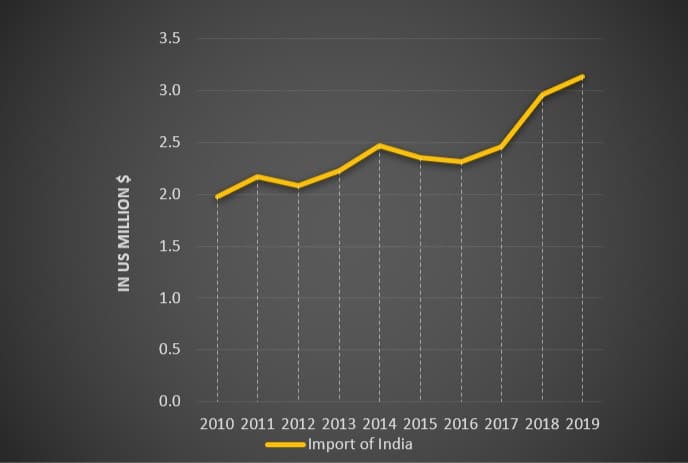

And the India’s pharma import…

We are able to see that India is importing more pharmaceuticals every year. A developing country like India shows a bad financial sign in this situation.

Comparatively, India’s pharmaceutical exports seem way behind those of China.

Let’s understand further, the various reasons for India’s dependency on China for Pharmaceuticals.

Reasons for India’s Dependency

To understand the reasons for dependency, we may categorize the contributing factors, particularly for APIs.

Commercial Aspects

Chinese imports are more profitable for Indian pharma manufacturers. This is because the production cost of APIs in China is around 25 -30% less than that of India.

With this, the Indian API manufacturers are able to import, formulate, and export drugs in a cost-effective manner.

There are two key factors responsible for this:

- Infrastructure Facilities

- Tax benefits

These two parameters directly bridge the government’s vision and their potential schemes.

As the manufacturer always thrives for profitability, this scenario would’ve been a non-profitable business for them. Rather, imports from China helped into a profitable business. This is an important factor affecting India China Pharma trade.

- Still, India has a pro compared to China and it’s the labor cost. China having more GDP than India makes its labor cost more expensive.

- In comparison with India, the Chinese government offers a broader array of subsidies and tax-saving measures, including low-cost lands and utilities like electricity, water, etc., reducing capital expenditures and operating costs. In this way, they are able to maintain higher scalability and export APIs to a broader extent. The key to Chinese success is volume, but India desperately needs it.

Environmental Factors

India stands firm on environmental safety, and pollution compared to China.

According to the Central Pollution Control Board of India, the API sector falls under one of the most polluting industries in the country and requires to follow strict environmental regulations.

Contrary, the Chinese industries received enough environmental relaxations from their government.

This has made India’s manufacturing pace slow compared to China and moved India’s focus towards environmental factors more.

Therefore, private firms in India considered easy to buy Chinese APIs than manufacturing at local levels.

Regulatory Compliance

In India, strategic policies are not implemented on the ground as smoothly as they should, which means business needs cannot be supported smoothly.

As for legal clearances, India is more complex compared to China in terms of filing and approval processes.

As a result, the efficiency of actual manufacturing is directly affected by this aspect, since interacting with different authorities comes with its own set of challenges.

Even though India has policies that will lessen its dependence on China, their implementation is not as smooth as it could be.

During the Covid-19 pandemic, India emerged as one of the few countries to control the spread and launch the vaccine on a fast-track for such a large population.

Additionally, India manufactured some APIs and vaccines on mission-mode including huge exports.

Recently, several Indian pharma manufacturers got serious observations from regulatory agencies regarding the Quality and Efficacy of the APIs.

This resulted in rework, corrective actions, and thereby time-delays due to the reduced rate of production than targeted.

Technology Improvements

This is the most contributing factor for India’s dependency on China as India surely has technology but at a cost.

While China also has technology but at a low-cost. Hence this factor directly affects India China Pharma trade.

For instance,

- Fermentation processes in India use raw materials like glucose and soya which we all know comes at a high cost.

- China uses cheap raw materials such as cauliflower. (Please note this also improves the quality of India’s drugs, yet at a cost).

On the technology front, Indian manufacturers have an easy option, i.e. “cheaper import”.

Tech revolution previously observed in the 1980s with the strategic goal of India becoming a generic drug manufacturer.

Indian Public Sector Enterprise mainly includes Hindustan Antibiotics Limited (HAL), Indian Drugs and Pharmaceuticals Ltd. (IDPL). Also, CSIR laboratories mainly include the Central Drug Research Institute (CDRI).

These institutions have contributed significantly to the acquisition, distribution, and expansion of required technologies for pharma during their era.

The Indian Govt. certainly lacked a futuristic approach in upgrading these industries from time to time in terms of technology and policies.

Though private firms have achieved a lot, definitely there is an opportunity to transform the public sector enterprises too.

Conclusion

The Indian government is now considering revival and growth for pharmaceutical industries to sustain future health crises.

This will require more strategic infrastructure and tax-saving schemes, which will promote current API manufacturers to increase their capacity and business.

These schemes should also ease the initial setup of the business, which will attract more investment.

There is a prime need for scientific investigations and a progressive approach for increasing the volume of APIs and intermediates. It will enable our nation firm and stern for protecting the interest of the pharma sector.

Properly structuring the existing complex approval procedures is a must. Equally, the system should be able to measure the execution of existing framed policies that’ll reduce India’s dependency on China.

Indian government should support and promote investment in Technology Research, Development, and Transformation of the public sector enterprises.

This will help in developing greener technologies to sustain and improve the Indian pharma sector in the competitive market.